China passes US as top FDI destination

17 january 2013

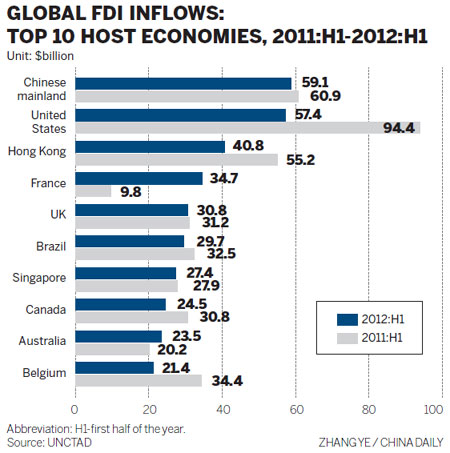

China has surpassed the United States for the first time since 2003 as the world’s largest recipient of global foreign direct investment in the first half of 2012, showing that global investors are still confident in the world’s second-largest economy despite its economic slowdown.

Meanwhile, FDI flowing to the US reached $57.4 billion, a decline of 39.2 percent from a year earlier, according to the Global Investment Trends Monitor released by the United Nations Conference on Trade and Development, or UNCTAD, on Tuesday.

“China’s biggest attraction to global investment is now its huge market, contrasting the long-time low cost, which is now ranked third or fourth,” said Zhang Xiaoji, director of the Foreign Economic Relations Development at the Development Research Center of the State Council, a top government think tank.

“The economy is anyway growing in China, outperforming the US and the European Union, which are suffering medium- or long-term troubles.”

Global FDI inflows reached $668 billion from January to June in 2012, a decline of 8 percent from the same period of 2011, as the economic recovery “suffered new setbacks in the second quarter of 2012”, said the report.

“FDI flows will, at best, level off in 2012 at slightly below $1.6 trillion because the slow and bumpy recovery of the global economy, weak global demand and elevated risks related to regulatory policy changes continue to reinforce the wait-and-see attitude of many transnational companies toward investment abroad,” the UNCTAD projected.

FDI inflows to the EU declined by 3.8 percent year-on-year to $175.9 billion for the first half of 2012 while inflows to North America were down by more than one-third due to a dramatic 39.2 percent year-on-year fall in inflows to the US, according to the report.

However, the UNCTAD also said that “FDI flows to the US might be stronger in the second half of 2012” in view of early indications.

The value of cross-border mergers and acquisitions in the US in the third quarter of 2012 were double those of the first half of the year, while some further acquisitions are “already taking place or announced in the fourth quarter”, according to the report.

Developing economies for the first time absorbed half of global FDI in the first half of 2012, despite a decline of 5 percent year-on-year.

“China is experiencing structural adjustments in their FDI flows, including the relocation of labor-intensive and low-end market-oriented FDI to neighboring countries,” said the report.

Members of the Association of Southeast Asian Nations demonstrated strong attraction for global foreign direct investment. FDI inflows to Cambodia surged by more than 165 percent year-on-year in the first half, while inflows to Thailand rose by 62.1 percent and inflows to the Philippines increased by 10.6 percent, according to the report.

“For investment oriented with low costs, pulling out is normal and will continue in the future owing to China’s rising costs and appreciation of local currency,” Zhang said.

Shen Danyang, spokesman for the Ministry of Commerce, said that China is “adjusting its use of FDI, which is developing positively and healthily despite a slight decrease of FDI inflow this year”.

Recent Comments