China overtakes US as leading FDI destination

16 january 2013

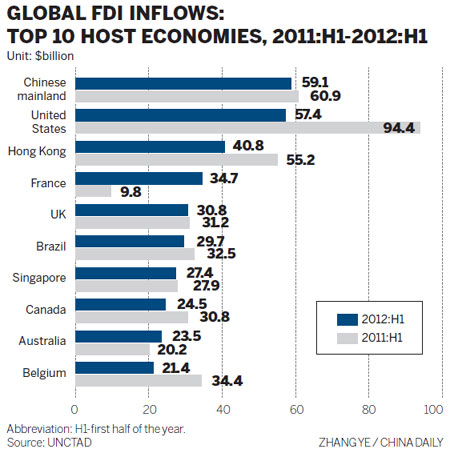

China has surpassed the United States for the first time since 2003 as the world’s largestrecipient of global foreign direct investment in the first half of 2012, showing that globalinvestors are still confident in the world’s second-largest economy despite its economicslowdown.

Meanwhile, FDI flowing to the US reached $57.4 billion, a decline of 39.2 percent from a yearearlier, according to the Global Investment Trends Monitor released by the United NationsConference on Trade and Development, or UNCTAD, on Tuesday.

“China’s biggest attraction to global investment is now its huge market, contrasting the long-time low cost, which is now ranked third or fourth,” said Zhang Xiaoji, director of the ForeignEconomic Relations Development at the Development Research Center of the State Council, atop government think tank.

“The economy is anyway growing in China, outperforming the US and the European Union,which are suffering medium- or long-term troubles.”

Global FDI inflows reached $668 billion from January to June in 2012, a decline of 8 percentfrom the same period of 2011, as the economic recovery “suffered new setbacks in the secondquarter of 2012”, said the report.

“FDI flows will, at best, level off in 2012 at slightly below $1.6 trillion because the slow andbumpy recovery of the global economy, weak global demand and elevated risks related toregulatory policy changes continue to reinforce the wait-and-see attitude of many transnationalcompanies toward investment abroad,” the UNCTAD projected.

FDI inflows to the EU declined by 3.8 percent year-on-year to $175.9 billion for the first half of2012 while inflows to North America were down by more than one-third due to a dramatic 39.2percent year-on-year fall in inflows to the US, according to the report.

However, the UNCTAD also said that “FDI flows to the US might be stronger in the second halfof 2012” in view of early indications.

The value of cross-border mergers and acquisitions in the US in the third quarter of 2012 weredouble those of the first half of the year, while some further acquisitions are “already takingplace or announced in the fourth quarter”, according to the report.

Developing economies for the first time absorbed half of global FDI in the first half of 2012,despite a decline of 5 percent year-on-year.

“China is experiencing structural adjustments in their FDI flows, including the relocation oflabor-intensive and low-end market-oriented FDI to neighboring countries,” said the report.

Members of the Association of Southeast Asian Nations demonstrated strong attraction forglobal foreign direct investment. FDI inflows to Cambodia surged by more than 165 percentyear-on-year in the first half, while inflows to Thailand rose by 62.1 percent and inflows to thePhilippines increased by 10.6 percent, according to the report.

“For investment oriented with low costs, pulling out is normal and will continue in the futureowing to China’s rising costs and appreciation of local currency,” Zhang said.

Shen Danyang, spokesman for the Ministry of Commerce, said that China is “adjusting its useof FDI, which is developing positively and healthily despite a slight decrease of FDI inflow thisyear”.

FDI flowing to China stood at $83.42 billion from January to September, down 3.8 percent froma year earlier, while September saw China’s FDI drop 6.8 percent year-on-year to $8.43 billion,according to the ministry.

Meanwhile, the services sector used nearly $39.5 billion in FDI, or 47 percent of the country’stotal, a decline of 1.8 percent year-on-year in the first nine months, though it would be anincrease of 1.6 percent if the real estate industry is excluded.

The HSBC preliminary manufacturing purchasing managers’ index, a main economic indicator,rose to 49.1 in October, the highest level in three months, supported by recovery of domesticdemand and business confidence while economists hold that China’s economic growth isreversing its slowdown after registering growth of 7.4 percent in the third quarter, the slowestpace in 14 quarters.

However, Supachai Panitchpakdi, secretary-general of the United Nations Conference onTrade and Development, said that “the current trends of investment flows to developingcountries, particularly to Asia, are worrisome, and the challenge for channeling FDI into keydevelopment sectors such as infrastructure, agriculture and the green economy remainsdaunting”.

Recent Comments