Economy ‘may have bottomed out in Q3’

17 january 2013

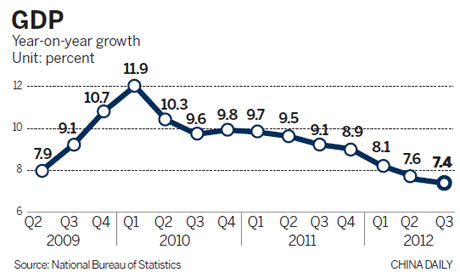

GDP growth hits three-year low but signs of recovery evident

The worst may be over as the economy shows signs of bottoming out, officials and analysts said despite GDP growth hitting 7.4 percent in the third quarter, a low of more than three years.

Domestic stock markets reacted to the remarks by rising to a five-week high on Thursday. The benchmark Shanghai Composite Index jumped 1.2 percent to 2,131.69.

The economy is on track to achieve its annual GDP growth target of 7.5 percent, Wen said.

|

|

| China Economy By Numbers — Sept |

GDP growth was 8.1 percent in the first quarter, and 7.6 percent in the second, according to the National Bureau of Statistics.

But September’s monthly industrial production growth accelerated to 9.2 percent year-on-year from the 38-month low of 8.9 percent in August, indicating growing domestic demand.

Growth of retail sales of consumer goods swelled to a six-month high of 14.2 percent, against 13.2 percent in August. The run-up to National Day saw increased consumer demand.

The NBS also showed that growth in fixed-asset investments reached 20.5 percent year-on-year in the first three quarters.

The data “can support our judgment that the economy may have bottomed out in the third quarter and is likely to see a moderate rebound in the last three months”, said Sheng Laiyun, the NBS spokesman.

The data will probably make it unnecessary for the government to roll out additional aggressive stimulus measures, said Louis Kuijs, chief China economist at the Royal Bank of Scotland Group.

The existing measures are enough to support a moderate recovery, said Pan Jiancheng, deputy director-general of the China Economic Monitoring and Analysis Center of the NBS.

The current momentum will “leave more space for restructuring the economy and changing its growth model”, Pan said.

In the first three quarters, service industries contributed 43.8 percent to GDP, against 42.6 percent for the same period last year, the National Bureau of Statistics reported.

Meanwhile, industrial production in high-tech sectors grew 11.7 percent from January to September, faster than traditional industries by 1.7 percentage points.

These were cited by Sheng as signs proving that a structural change is happening and industry upgrading is accelerating.

Wen also pledged to do more to boost growth, including improving credit and supporting products that enhance energy saving.

Measures to improving agriculture, food production and increase the supply of housing units will also be introduced.

“Going forward, domestic demand holds the key for China’s growth recovery, while external challenges remain,” said Qu Hongbin, the chief China economist with the HSBC Holdings.

“There is still a chance for a 25 basis points interest rate cut, but the central bank is more likely to rely on quantitative easing tools, such as liquidity injection through open market operation and reserve requirement ratio cuts,” Qu said.

Commenting on the latest China data, Duncan Freeman, senior research fellow at the Brussels Institute of Contemporary China Studies, said there may be still difficulty ahead and “whether China can avoid a further slowdown will depend very much on the domestic response”.

Recent Comments