Low inflation ‘offers stimulus opportunity’

17 january 2013

Conditions ripe for growth measures, economists say

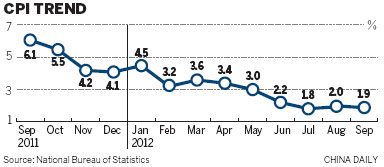

A period of mild inflation may offer a greater opportunity for further stimulus, economists said after the government reported on Monday that the September consumer price index increased 1.9 percent year-on-year.

The CPI, a key inflation gauge, grew 2 percent in August and hit a two-year low of 1.8 percent in July. The second half of this year has seen low inflation and conditions are ripe for economic recovery in the last quarter, supported by the easing of fiscal and monetary policies since the second quarter, economists said.

|

|

According to the National Bureau of Statistics, food prices increased 2.5 percent year-on-year in September, 0.9 of a percentage point slower than the August rate, as prices for pork and fresh vegetables fell markedly when supply expanded.

The producer price index, an indicator of wholesale inflation, declined 3.6 percent year-on-year in September.

It is the lowest since November 2009. In August it dropped 3.5 percent and July saw a fall of 2.9 percent, suggesting that demand for producer goods was still weak.

But there are signs of manufacturing and market demand rebounding, driven by the moderate stimulus program since April, said Xu Hongcai, a senior economist with the China Center for International Economic Exchanges, a government think tank.

Now is “a good time to keep boosting growth” through the government-designed stimulus programs, he said.

The pro-growth policies that China has already rolled out are creating new investment demand and will start showing their full effect in the coming months, he predicted.

GDP will probably grow 7.7 percent year-on-year in the fourth quarter and exceed the government target of 7.5 percent for the whole year, he said.

Zhang Zongping, a sales manager for a trading company in Shanghai, said that export demand increased since September thanks to orders for Christmas and New Year.

The official GDP data will be released on Thursday. Many economists predict the three-month period to the end of September will see a seventh consecutive quarterly deceleration.

Economists expect signs of a recovery later this year or in early 2013, but they also fear that global demand will remain weak.

Trade data released on Saturday showed imports revived slightly from the previous month’s contraction but grew by only 2.4 percent, suggesting a recovery has yet to take hold.

GDP growth was 7.6 percent year-on-year in the second quarter, down from 8.1 percent in the first three months.

Starting from the second quarter, the government has eased monetary policy through cutting both the benchmark interest rates and the reserve requirement ratio to increase market liquidity and encourage investments.

The broad money supply surged in September by 14.8 percent year-on-year, a 15-month high, compared with 13.5 percent in August, according to the central bank.

“The September monetary data show that credit and bond issues have already been relaxed to support economic growth,” said Huang Yiping, chief economist for emerging Asia at the investment banking division of Barclays.

Huang said a further interest rate reduction in the last three months of this year is constrained by concerns about a rebound in property prices.

Although the full-year CPI level will be modest, medium-term inflation may remain significant due to the growth rebound and the easing monetary environment around the globe, Yi Gang, vice-governor of the People’s Bank of China, the central bank, said at the annual meeting of the International Monetary Fund and the World Bank in Tokyo on Sunday.

Analysts warned that China should be prepared for “imported inflation” caused by a new round of quantitative easing, known as QE3, in the United States.

“QE3 will lift commodity prices. The price rises will be passed on to China because the country is a huge importer of commodities,” said Zhuang Jian, a senior economist with Asia Development Bank.

“If the rebound continues, we think policymakers are likely to lean more toward ‘wait and see’, especially in the absence of signs that employment is deteriorating,” said Helen Qiao, a senior economist with the Morgan Stanley Asia Ltd.

Recent Comments